Property Profile Diversification in New York: A Strategic Overview

Expanding your real estate portfolio is a keystone technique for long-lasting monetary security and development. In New york city, a state known for its vibrant realty market, the possibilities for diversification are vast and fulfilling. Whether you're an experienced financier or simply beginning, understanding how to diversify efficiently in New York's market can set you on the course to success.

This guide will certainly discover the advantages of portfolio diversity, essential approaches, and possibilities certain to the New York property market.

Why Expand Your Property Portfolio?

Diversification entails spreading financial investments across different property types, places, and residential or commercial property groups to lessen risk and take full advantage of returns. Below's why it's important:

1. Threat Mitigation

Buying various residential property types or regions minimizes the effect of market variations on your profile.

2. Consistent Cash Flow

By branching out, you can make sure a constant income stream even if one industry underperforms.

3. Resources Growth

Different markets and residential or commercial property kinds appreciate at differing rates, offering more opportunities for lasting gains.

4. Economic Resilience

A well-diversified profile can stand up to economic declines by balancing risky and secure investments.

Opportunities for Real Estate Diversification in New York City

New York uses a series of real estate opportunities across urban, rural, and rural areas. Here's a break down:

1. Urban Investments

New York City controls the urban market with deluxe homes, business areas, and high-demand rentals. Locations like Manhattan and Brooklyn are prime for high-income capitalists seeking long-term admiration.

2. Suv Development

Suburban areas such as Westchester Area and Long Island give possibilities in single-family homes, condominiums, and mid-tier leasings. These areas cater to family members and experts seeking closeness to NYC.

3. Upstate Qualities

Upstate New York, consisting of cities like Albany and Buffalo, provides budget friendly investment alternatives. Multifamily units, holiday rentals, and business buildings accommodate a growing need for cost effective living and tourism.

4. Business Real Estate

From retail areas in dynamic urban centers to commercial storage facilities in the borders, commercial homes in New York give high-income potential with long-lasting lease stability.

5. Holiday Rentals

Tourist-heavy regions like the Catskills and Saratoga Springs are excellent for temporary rentals, specifically during peak periods.

Strategies for Expanding Your Profile in New York

1. Spend Across Building Types

Integrate household, commercial, and industrial properties to produce a balanced profile.

Residential: Single-family homes, apartments, or multifamily units.

Commercial: Workplace, retail stores, and mixed-use growths.

Industrial: Warehouses or manufacturing facilities, especially in growing suburbs.

2. Discover Geographic Diversification

Prevent putting all your financial investments in one city or area. New york city State's varied landscape supplies possibilities in metropolitan and rural areas.

3. Consider Market Trends

Stay upgraded on financial advancements, framework jobs, and migration patterns to identify emerging markets in New york city.

4. Usage REITs for Wider Exposure

Property Investment Trusts (REITs) offer an chance to buy large homes without straight ownership, spreading your threat across several possessions.

Advantages of Expanding in New york city's Market

1. High Need Throughout Fields

New york city's varied economy ensures strong need for property, business, and industrial residential or commercial properties.

2. Long-Term Admiration

Properties in vital areas like NYC and the Hudson Valley traditionally appreciate, using robust returns over time.

3. Tourism-Driven Markets

Temporary leasings in traveler locations like Lake Placid or Niagara Falls produce seasonal income and satisfy a growing Airbnb market.

Challenges to Take into consideration

While New York's property market is rewarding, diversification features challenges:

High First Costs: Urban locations like NYC call for significant capital expense.

Laws: Rental fee control laws and zoning laws may influence success.

Market Competitors: Popular regions commonly have intense competition for top quality homes.

Mindful planning and due persistance are important to overcoming these challenges.

Study: Successful Portfolio Diversity

An investor started with a single-family home in Queens, NEW YORK CITY, creating rental income. To branch out:

They acquired a vacation leasing in the Adirondacks for seasonal revenue.

Added a industrial building in Syracuse, benefiting from the city's financial development.

Bought an industrial storage facility in Westchester for steady lasting leases.

This mix of property types and places stabilized their threat and boosted total returns.

Property portfolio diversification in New York is a tactical transfer to construct riches and lessen danger. With its selection of city, suv, and rural markets, New york city uses something for every single capitalist.

By discovering various property types, leveraging geographical variety, and remaining educated concerning market fads, you can develop a resistant and successful profile. Whether you're looking at New York City's high-end apartment or condos or Upstate's budget friendly multifamily devices, the https://sites.google.com/view/real-estate-develop-investment/ possibilities are limitless.

Begin diversifying your portfolio in New York today to secure your economic future!

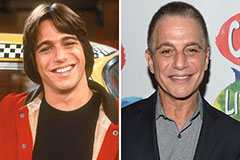

Tony Danza Then & Now!

Tony Danza Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!